Explaining the Banking Situation Through Memes

This week’s installation is going to tell the story of the current banking situation through memes we’ve collected from Finmeme accounts over the last couple of weeks for your entertainment.

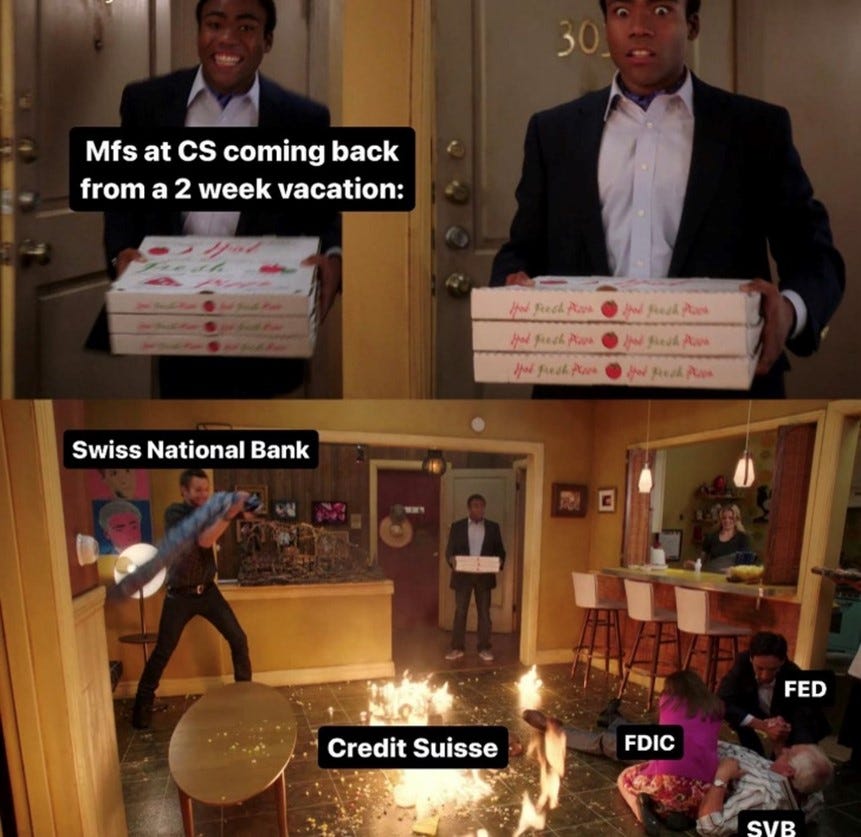

Recently, there's been a lot of worry about the stability of the global banking sector, with some people saying it's similar to the financial crash of 2008. This is because of two things that have happened: Silicon Valley Bank in the US collapsed, and Credit Suisse, a Swiss bank, had to take out a huge loan from the central bank.

Source: @nonequitypartner on Instagram

The banking crisis is a good reminder that financial institutions and markets are heavily influenced by how people think and feel. A bank can seem perfectly fine one minute, but if people start to lose faith in it and rush to take out their money, it could quickly go bust.

This week’s installation of The Green Tea is going to tell the story of the current banking situation through memes we’ve collected from Finmeme accounts over the last couple of weeks for your entertainment.

Source: @bullishsecurities on Instagram

Timeline of Events

Feb 24th – KPMG gives Silicon Valley Bank a clean audit report for 2022.

Mar 8th – Silvergate Bank shuts down, and Silicon Valley Bank reports a $1.8 billion loss after selling investments to cover withdrawals.

Mar 9th – Silicon Valley Bank’s stock drops, and fears of bank losses cause other U.S. banks' shares to slide.

Mar 10th — The FDIC takes control of Silicon Valley Bank, which experienced the largest U.S. banking collapse since 2008.

Mar 11th – Tech startups struggle to find funding after their deposits are locked up in the failed bank.

Mar 12th — The FDIC takes control of a second bank, Signature Bank, and announces a new lending program for banks.

Mar 13th – President Biden reassures the public that the banking system is safe, but regional bank stocks continue to slide.

Mar 14th – The Justice Department and Securities and Exchange Commission investigate Silicon Valley Bank's collapse, and the Federal Reserve rethinks its rules for midsize banks.

Mar 15th — Credit Suisse's shares drop, and Swiss authorities announce a backstop to calm the market panic.

Mar 16th — First Republic Bank faces potential collapse, but a private sector rescue plan saves it.

Mar 17th – Silicon Valley Bank’s parent company files for chapter 11 bankruptcy protection.

Mar 18th – UBS Group nears a deal to take over Credit Suisse in an effort to restore trust in the banking system.

Mar 19th — UBS Group nears a deal to take over Credit Suisse to restore trust in the banking system.

Background

Interest Rates

Source: @bullishsecurities on Instagram

The Federal Reserve changes interest rates to help the economy. When the economy is good and there's low unemployment, they may raise rates to prevent prices from going up too much. When the economy is bad and unemployment is high, they may lower rates to encourage people and businesses to borrow money and spend it, which can create jobs and stimulate economic activity. In 2022, the Fed raised rates several times to prevent inflation from rising too much. In 2023, interest rates will depend on economic growth and other factors. The Fed plans to continue raising rates gradually, but will adjust based on how the economy is doing. Other central banks may do the same.

Balance Sheet Shape & Duration Mismatch

Source: @bullishsecurities on Instagram

A balance sheet is a financial statement that shows a company's assets (things it owns), liabilities (debts it owes), and equity (what's left over for shareholders). Companies need to make sure that they have enough assets to cover their liabilities, so they can pay their debts and meet other financial obligations. Now, when a company takes on debt, it usually has to pay interest on that debt over time. The length of time it takes to pay off that debt is called the "duration" of the debt.

In the banking industry, many banks borrow short-term money from depositors (people who put their money into savings accounts, for example) and then lend that money out for longer-term loans (like mortgages for people buying homes). This means that the duration of the bank's liabilities (what it owes to depositors) is usually shorter than the duration of its assets (the loans it has made to borrowers).

This can create a problem called "structural duration mismatch." If a bank's assets are tied up in long-term loans and its liabilities are short-term deposits, it can become difficult for the bank to pay back its depositors if they want their money back quickly. This is because the bank might not be able to sell its long-term assets quickly enough to raise the cash needed to pay off its short-term debts.

This is why banks have to manage their balance sheets carefully and make sure that they have enough liquidity (cash and easily-sellable assets) to meet their obligations to depositors and other creditors.

How Interest Rates Affect Duration Mismatch

Duration mismatch can be an issue when interest rates rise because it can lead to a decrease in the value of assets that have longer maturities, such as bonds, compared to liabilities that have shorter maturities, such as deposits. This happens because when interest rates rise, the value of the fixed-income securities that the bank holds on its balance sheet decreases, while the value of the liabilities, such as deposits, remain fixed.

Source: The New York Times

What’s Happening Now?

Silvergate Capital

Silvergate Bank is a financial institution based in California that started out as a regular savings and loan business. However, in 2013, the bank shifted its focus toward Bitcoin and cryptocurrency, creating the Silvergate Exchange Network to help clients exchange digital currencies for traditional currencies like the U.S. dollar. It is one of the main banks for crypto companies and has over $11 billion in assets. Silvergate Bank explored launching its own stablecoin and bought Diem Association, a cryptocurrency platform formerly backed by Facebook. However, its stablecoin efforts did not materialize, and the bank's shares began to plummet due to industry and regulatory developments, including concerns around the collapse of crypto exchange FTX.

On March 8th, Silvergate Bank announced it was winding down operations and liquidating its bank due to these challenges. The liquidation plan ensures that all deposits will be fully repaid, but it's unclear how claims against the business will be resolved.

Silicon Valley Bank

Source: @bullishsecurities on Instagram

Regulatory authorities intervened on March 10, 2023, to close Silicon Valley Bank, the 16th largest financial institution in the United States, due to significant investment losses and a subsequent flurry of deposit withdrawals. The bank's primary clientele was comprised of tech startups and venture-backed companies, which meant that for decades, Silicon it was flush with cash from high-flying start-ups. They did what most other banks do by keeping some of their cash and investing the rest in things like Treasury bonds.

Banks invest in Treasury bonds because they are considered to be low-risk, stable investments that offer a modest, but reliable, return. Treasury bonds are issued by the US government, and they are backed by the full faith and credit of the US government, which means they are considered to be very safe. These bonds are also highly liquid, which means they can be easily bought and sold in the market. Therefore, banks invest in Treasury bonds to generate a steady income while minimizing their risk exposure.

Unfortunately, Silicon Valley Bank didn't take into account that the economy had been artificially boosted by the pandemic, which made the whole thing a bit too hot to handle. In the end, the bank lost too much money and people took out too much cash, so the regulators had to shut it down.

Lack of Chief Risk Officer

Source: @finance_god on Instagram

Silicon Valley Bank is currently under investigation by the Federal Reserve, and one of the areas being examined is the fact that the bank did not have a chief risk officer (CRO) for a significant portion of 2022. The previous CRO, Laura Izurieta, left her role in April of that year and departed the company completely in October. Kim Olson was appointed as the new permanent CRO in January of the following year. It is not clear how the bank handled risk management during the time in which it did not have a CRO.

Rising Interest Rates

Source: @bullishsecurities on Instagram

Silicon Valley Bank had invested a significant portion of its deposits in long-term debt instruments like government bonds, which promised a steady, but modest, return when interest rates were low. However, as the Federal Reserve implemented measures to combat rapid inflation, they began to raise interest rates, which made the bank's once-safe investments appear less attractive. As newer government bonds started offering higher interest rates, the bank's fixed interest payments could not keep up with the rising rates. This made their existing assets worth less than what the bank had initially paid for them. By the end of last year, the bank was faced with more than $17 billion in potential losses on these investments. In short, the bank's investment strategy proved to be risky as it had failed to account for the changes in the wider economic climate and how they could affect their investments.

A Unique Client Demographic

Source: @litquidity on Instagram

While rising interest rates played a role in Silicon Valley Bank's downfall, not all of its problems can be attributed to this factor. The bank's unique business model also contributed to its rapid demise. As the bank's primary focus was on the tech industry, it began to experience trouble when start-up funding began to dry up. This led its clients, which were predominantly technology start-ups and their executives, to withdraw more money from their accounts. Since these were corporate deposits, they were often larger than the Federal Deposit Insurance Corp.'s insurance limit of $250,000. As of the end of last year, Silicon Valley Bank had over $150 billion in uninsured deposits. These big, uninsured depositors tend to be the kind of investors who tend to withdraw their money during signs of turbulence. As a result, when the bank started to experience financial difficulties, these investors were quick to pull out their deposits, exacerbating the bank's problems.

The Bank Run

Source: @litquidity on Instagram

After Silicon Valley Bank revealed its significant loss on Wednesday, the tech industry became anxious and start-ups began to rapidly withdraw their funds. This resulted in a bank run, which occurs when there is a sudden and simultaneous withdrawal of deposits by customers, leading to a liquidity crisis. It is difficult to determine the specific reasons behind a bank run, as it is often driven by crowd psychology and can be triggered by a variety of factors. In this case, fears may have arisen after the bank announced its intention to raise capital and sell a large amount of securities at a loss. Silicon Valley Bank primarily served venture capitalists and technology startups, and on March 8th, the bank announced that it had sold $21 billion in securities at a loss of $1.8 billion and would be seeking to raise $2.25 billion in capital. Despite these efforts, the bank was unable to raise the necessary funds to cover the outflows, prompting regulators to step in and close the bank.

The FDIC Steps In

Source: @litquidity on Instagram

In response to the collapse of Silicon Valley Bank, federal regulators made assurances that all depositors would be compensated, even for funds that exceeded the $250,000 limit protected by the Federal Deposit Insurance Corporation (FDIC). This was done to reassure depositors and prevent a larger panic that could spread to other banks. The Federal Reserve also took steps to restore confidence in the banking system and prevent future bank failures. One of these measures was the introduction of the Bank Term Funding Program, which aimed to provide banks with longer-term funding to prevent short-term funding squeezes that can lead to financial instability. This program was designed to provide banks with access to liquidity during times of stress, thereby reducing the risk of bank runs and systemic crises.

The Fallout

Silicon Valley Bank's failure was significant due to its size and reputation as a leading bank for startups and venture-backed firms. The bank's collapse led to concerns about the ability of smaller regional banks to withstand losses on bond portfolios caused by rising interest rates, and sparked worries about the stability of other banks. The fallout from SVB's collapse also affected other banks, such as First Republic Bank whose shares plummeted by 52%.

Signature Bank

Two days after the FDIC took over Silicon Valley Bank, regulators in New York shut down Signature Bank to prevent risks in the wider financial system. Signature Bank primarily provided lending services to law firms and real estate companies, and in 2018, it started accepting deposits of cryptocurrency assets. However, this decision proved costly after the industry took a hit following the collapse of FTX cryptocurrency exchange. Like Silicon Valley Bank, most of Signature Bank's customers had deposits larger than the FDIC's insurance limit of $250,000, and almost 90% of the bank's roughly $88 billion in deposits were uninsured at the end of last year. To address the uninsured deposits of both banks, the FDIC, Treasury Department, Federal Reserve, and President Biden used a "systemic risk exception."

First Republic

Source: @bullishsecurities on Instagram

First Republic Bank is a regional bank that has a large amount of uninsured deposits above the FDIC limit of $250,000. The bank uses a portion of customers’ deposits to give out loans to other customers. However, the bank has lent out more money than it has in deposits from customers, making it a risky bet for investors. This has led to many customers exiting the bank and putting their money elsewhere.

The recent collapses of Silicon Valley Bank and Signature Bank have raised concerns about the banking system, and many investors are worried that similar issues may arise at First Republic. In response, a group of financial institutions has agreed to deposit $30 billion in First Republic to show their confidence in the banking system. The deposits are obligated to stay at the bank for at least 120 days, according to an announcement from First Republic.

JPMorgan, Bank of America, Wells Fargo, Citigroup, Goldman Sachs, Morgan Stanley and other big banks pitched in to help First Republic Bank. It all started with a phone call between JPMorgan CEO Jamie Dimon, Federal Reserve Chair Jerome Powell, Treasury Secretary Janet Yellen, and Federal Deposit Insurance Corporation Chair Martin Gruenberg. They came up with the idea that JPMorgan could give some deposits to First Republic to help the bank deal with withdrawals, just like what happened to Silicon Valley Bank. Dimon then talked to other bank executives, and a group of 11 banks pledged to deposit a total of $30 billion in First Republic. They want to show that they have confidence in the banking system and their commitment to help banks serve their customers and communities.

However, there are still concerns that the deposit infusion may not be enough to shore up First Republic in the future, and the market's reaction to the bank could affect the Federal Reserve's decision over whether to raise interest rates by a quarter-percentage point or to forgo an increase altogether in their rate-setting meeting. Despite the deposit infusion, shares of First Republic were under severe pressure, and the bank may need an additional $5 billion in capital.

Credit Suisse

Source: @finance_god on Instagram

Credit Suisse is a Swiss-based global lender that has had many scandals over the years, and this week its share price fell to an all-time low, causing panic among investors who sold shares in other banking stocks. Credit Suisse's problems are not connected to the collapses of SVB and Signature banks. The bank has been involved in several scandals, including mismanaging funds, failing to prevent money laundering by a drug gang, losing a court case that cost it $600 million, and spying on former employees. Some investors fear that Credit Suisse's stock could become worthless, and a failed resolution could cause problems for other financial institutions in Europe and beyond.

Swiss National Bank

Source: @ibd_memes on Instagram

The Swiss National Bank, which acts as a central bank for banks in Switzerland, has decided to loan Credit Suisse up to $54 billion to help the troubled bank. This announcement caused Credit Suisse's shares to rise as much as 33% on Thursday, before settling on a 17% gain as investors rallied around the central bank's efforts to prevent the bank from collapsing.

UBS

Source: @litquidity on Instagram

UBS, a Swiss bank, has agreed to acquire Credit Suisse, another Swiss bank, for CHF 3 billion ($3.2 billion) with the support of regulators. The acquisition was sought to protect the wider financial system from the contagion of banking issues. The Swiss National Bank, along with the Swiss government and the Swiss Financial Market Supervisory Authority, helped bring about the combination of the two biggest banks in Switzerland. Under the deal's terms, Credit Suisse shareholders will receive 1 UBS share for every 22.48 Credit Suisse shares. The deal has been praised by US Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell.

Source: @litquidity on Instagram

What Does This Mean for the Future?

The problems that started at Silicon Valley Bank have spread to other banks. Credit Suisse, a giant bank in Switzerland, is also facing concerns about its stability. In the US, the authorities organized a bailout for First Republic, one of the large banks that worried investors. If small banks have problems, it could affect the economy by making it harder for people to get loans for things like mortgages or business expansion. Analysts think this could have the same effect as a half-point increase in Fed interest rates. Investors are still worried about the crisis, as regional bank stocks continue to drop.

Is My Money Safe / Do I Need To Pull Out Cash?

Banks in the US and Europe have insurance programs that protect depositors in case a bank fails. In the US, the Federal Deposit Insurance Corporation (FDIC) insures individual accounts up to $250,000 and joint accounts up to $500,000. So, if you have an account with less than $250,000 in a US bank insured by the FDIC, you should be fine even if the bank fails. In Europe, the amount of protection varies by country. In Switzerland, for example, each depositor is insured up to 100,000 Swiss francs (around $108,000), while in the UK, depositors can receive up to £85,000 (around $102,000) returned if their bank goes under.

Is It Going To Be Harder To Get A Loan?

Basically, when banks are under stress, they become more cautious about lending money. This means that they will scrutinize potential borrowers more carefully, whether it's businesses looking for loans or individuals trying to get a mortgage to buy a home. If banks are stressed, they may be hesitant to lend money, which can make it more difficult for people to get loans. This can lead to credit becoming more expensive, meaning that borrowers will have to pay higher interest rates on their loans, and it may also become less available, meaning that people may have trouble getting approved for loans in the first place. This is something that US Treasury Secretary Janet Yellen and European Central Bank President Christine Lagarde have both warned about.

Additional Resources

Overview

Global banking crisis: What just happened?

What is happening to banks and why are people talking about a crisis?

World markets set for relief after Credit Suisse buyout, central banks action

Bank Runs, Crypto Concerns and Takeovers: A Timeline of the Panic

The Banking Crisis: A Timeline of Silicon Valley Bank’s Collapse and Other Key Events

The Banking Crisis: A Timeline of Key Events

Why People Are Worried About Banks

Silicon Valley Bank

What Happened to Silicon Valley Bank?

What Happened With Silicon Valley Bank?

Silvergate Capital

Crypto-focused bank Silvergate is shutting operations and liquidating after market meltdown

Silvergate Stock Sinks on Liquidation News

First Republic

First Republic Bank Looms Large for U.S. Regulators After Credit Suisse Sale

First Republic shares slid almost 33% after deposit infusion, dragging down other regional banks

Wall Street rides to the rescue as 11 banks pledge First Republic $30 billion in deposits

Hear what weakened First Republic Bank and triggered $30B bailout

First Republic secures $30 billion rescue from large banks

Inside the $30 billion rescue of First Republic Bank

Credit Suisse

Fail or sale? What could be next for stricken Credit Suisse

CNBC Daily Open: UBS agrees to buy Credit Suisse

UBS buys Credit Suisse for $3.2 billion as regulators look to shore up the global banking system

Credit Suisse: what is happening at Swiss bank and should we be worried?