Why The Debt Ceiling Is Making Headlines

The accumulation of debt over the past 20 years, due to tax reductions, economic downturn measures, and bipartisan spending, has led to another potential crisis regarding the federal debt limit.

The accumulation of debt over the past 20 years, due to tax reductions, economic downturn measures, and bipartisan spending, has led to another potential crisis regarding the federal debt limit. Last week, America hit its debt limit. Here’s what you need to know:

First of all, how is the federal budget set?

The federal budget cycle is like a plan for how the government will spend its money, similar to how a family makes a plan for how to spend their money. Every year, the President makes a suggestion for how much money should be spent on different things, like fixing roads and helping people. Then, the group of people in charge of the money (Congress) talks about the plan and decides how much money should go to different things. They also make sure that the government doesn't spend more money than it has. This process can take a long time and sometimes people disagree on what should be done. In the end, they come to an agreement, like a family does when deciding how to spend their money. If they can't agree on a plan before the end of the year, they make a temporary plan so the government can still run smoothly.

Why do I keep seeing headlines about hitting the debt ceiling?

The U.S. government has reached its limit on how much debt it can take on, called the debt limit. This means the government can't borrow more money until the limit is raised. The government is using temporary ways to get more money without going over the limit. The length of time these measures will work will depend on things like how much money the government gets from taxes. It's expected that a decision will be made this summer. The process of raising the debt limit will be difficult because different groups in Congress disagree and because the Democrats have control of the Senate and the Presidency. It's likely that the limit will be raised, but it may take several votes and happen at the last minute. This is a political problem, not a financial one, and each side wants something in return. If the usual ways to raise the debt limit don't work, there are other options but they are also difficult. There's also a small chance that the President will use special powers to avoid default, but it's unlikely. This situation could cause some changes in the stock and bond markets, but usually it's a good opportunity for long-term investors to buy.

Okay, but what is the debt ceiling?

The federal debt ceiling is like a credit card limit for the government. Just like you have a limit on how much you can borrow on your credit card, the government also has a limit on how much it can borrow to pay for things like fixing roads, helping people in need, and running the military. When the government needs to spend more money than it has, it borrows money just like you would put a charge on your credit card. But, when the government reaches the limit of how much it can borrow, it can't borrow any more money, just like when you reach the limit on your credit card, you can't make any more charges. This can cause problems for the government because it may not have enough money to pay for important things. So, Congress sometimes has to raise the limit on how much the government can borrow, just like you would ask for an increase on your credit card limit.

The history of raising the debt ceiling

Raising the debt ceiling used to be a regular thing that happened after Congress approved spending and paid for the country's programs and services. But in the past 10 years, it has become a political tool used by some members of the Republican Party. This has led to big fights in 2011, 2013, and now in 2023. The current debate is similar to the one in 2011 where some new Republicans in the House of Representatives refused to raise the debt limit without cutting spending. This caused a big fight between the Obama White House and the Republicans. The negotiations failed and the government almost didn't pay its bills, which would have been very bad. The lessons from 2011 are being used in the current debate, but it looks like it will end the same way with neither side willing to change their minds.

Clearly, this issue has become politicized, but are Republicans or Democrats more at fault for the current level of debt?

The Daily

Research conducted by The Daily concluded that over the last 20 years (since we last had a budget surplus), neither party was more at fault for the current level of debt. The research dug into policy commitments from each presidency and summed up the debt taken on.

After assessing the aggregate debt taken on by Republican and Democratic presidents, The Daily surmised that both parties have approved policies that required taking on more (roughly equivalent levels of) federal debt.

Austin American Statesman

This isn’t the first research of its kind however. The Austin American Statesman ran a similar analysis in 2021 and found that no president has been totally responsible for the debt that accumulated during his administration. The spending and tax bills that the president signs are written by Congress, which has been controlled by both parties over the past three decades. Additionally, the debt record of each president is influenced by laws and spending plans that were passed before they took office. Programs such as Social Security payments have a significant impact on the country's fiscal situation, regardless of who is in the presidency.

The U.S. government has been borrowing money and adding to the national debt since World War II because of spending on wars, crises, and government programs, as well as tax cuts. Recently, President Biden proposed a $1.9 trillion plan to help with the pandemic, and this added to the debt. The Democrats are also planning to spend more money on infrastructure and social programs, which will also add to the debt. The debt increased by $7.8 trillion during President Trump's time in office. This was due to different factors such as spending on COVID-19 relief, which was supported by both parties and included the $2.1 trillion CARES Act and a $950 billion relief package. Additionally, the debt increase was caused by plans supported only by Trump and the Republicans, such as the 2017 Republican Tax Cut and Jobs Act, which lowered taxes but also decreased the government's income by $500 billion. The pandemic made the debt problem worse and before it happened, the debt had already increased by $3.3 trillion under Trump.[AH1]

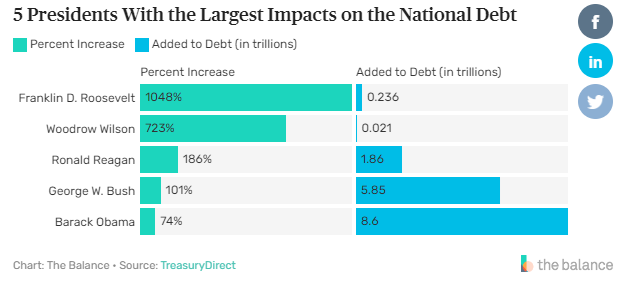

The Balance

The Balance took a different approach to come to the same conclusion. Rather than measure the debt level from when a president enters office to the debt level when they leave or compare the debt as a percentage of economic output (which takes into account the size of the economy at the time the administration accumulated the debt), The Balance recommends adding up budget deficits and compare that total to the debt level when presidents took office. In their analysis, The Balance identified the 5 presidents with the largest impacts on the national debt (over the entire history of our country) and found that both Republicans and Democrats have contributed significantly to the national debt.

In Conclusion

We have hit the debt ceiling, but this is normal.

Historically, raising the debt ceiling has not been politically contentious.

Republican and Democratic party alike have contributed to the national debt, in roughly equal amounts.

The risks of not raising the debt ceiling far outweigh any potential risks associated with raising it.

Further Reading

House Republicans gear up for a debt ceiling fight with the White House and Senate Democrats

The U.S. Hit the Debt Ceiling. How Bad Will It Be?

What Democrats and Republicans can learn from the 2011 debt ceiling showdown

Debt Ceiling Showdown: What Investors Need To Know

What Democrats and Republicans can learn from the 2011 debt ceiling showdown