How “Anti-ESG” Could Make the ESG Movement Even Stronger

Today's post discusses the anti-ESG movement and how it causing us all to think more critically about ESG investing

Vanguard's recent decision to exit from the Net Zero Asset Managers (NZAM) initiative is a clear indication that the anti-ESG movement led by US Republicans is having an impact on investors and the way they approach environmental, social and governance (ESG) factors. This move by Vanguard, one of the largest investment management companies in the world, to withdraw from an initiative that focuses on achieving net-zero emissions, is a significant blow to the ongoing efforts to combat climate change and promote sustainable investing.

The anti-ESG movement, which aims to restrict the consideration of ESG factors in investment decisions, has gained momentum in recent years, particularly in states like Florida, Texas, and Oklahoma. This movement is being led by politicians and policymakers who argue that ESG investing is a form of political activism that limits the potential return on investments. They also claim that ESG investing is costly and could harm the economy.

However, the exact extent to which the anti-ESG movement could hinder the energy transition and the fight against climate change is unclear. The energy transition is a complex and multi-faceted process that requires the participation of various stakeholders, including governments, investors, companies, and consumers. The anti-ESG movement could potentially slow down the progress of the energy transition by limiting the flow of capital toward sustainable energy and technology. However, it is also possible that the movement could be counteracted by the growing awareness of the materiality of ESG factors on long-term financial performance and the increasing pressure from regulators, investors, and other stakeholders to integrate these factors into investment decisions.

State-Level Anti-ESG Movement

Republican state attorneys general and members of Congress are criticizing environmental, social, and governance (ESG) investing practices, which they refer to as "woke capitalism". They argue that these practices prioritize climate change and societal issues over the fossil-fuel industry and view it as part of a broader Democratic effort. This political stance is supported by prominent Republicans such as Mike Pence, Ron DeSantis, and Greg Abbott, as well as wealthy GOP supporters and right-wing activists who have spoken out against Wall Street companies such as BlackRock for catering to a Democratic agenda.

Florida

In 2022, Florida Governor Ron DeSantis proposed a ban on "social, political or ideological interests" and legislation that prohibits state money managers from considering ESG factors. Florida's Board of Advisors adopted this proposal, and its CFO withdrew $2 billion from BlackRock and advised the state's investment arm to stop working with the firm, signaling further withdrawals may happen. This is the largest anti-ESG withdrawal announced by any state.

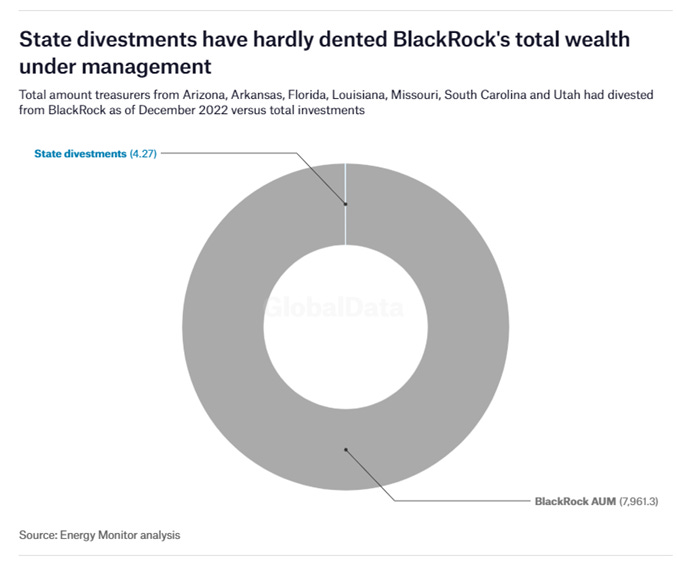

Authors’ Note: While this may sound like a lot of money - compared with BlackRock’s total assets under management of ($10 trillion), it is hardly a drop in the ocean (less than 0.02%).

On January 17th, DeSantis and Trustees of the State Board of Administration (SBA) formally approved measures to protect Florida’s investments from “woke environmental, social, and corporate governance (ESG)”. Additionally, DeSantis proposed:

Prohibiting big banks, credit card companies, and money transmitters from discriminating against consumers for their religious, political, or social beliefs.

Barring financial institutions from considering so called “ESG Credit Scores” in banking and lending practices to prevent Floridians from obtaining financial services like loans, lines of credit, and bank accounts.

Permanently prohibiting State Board of Administration (SBA) fund managers from considering ESG factors when investing the state’s money.

Requiring SBA fund managers to only consider maximizing the return on investment on behalf of Florida’s retirees.

Texas

In 2021, Texas became the first state to pass anti-ESG legislation that prohibits local authorities from doing business with banks that have adopted ESG policies and divested from Texas fossil fuel-based energy companies. Texas Comptroller, Glenn Hegar, published a list in 2022 of 10 firms and 348 funds to divest from. New Texas legislation, House Bill 645, prohibits financial institutions from using "value-based criteria" in their business practices, including discrimination or advocacy based on social media activity, political affiliation or ESG standards.

However, this legislation has resulted in increased costs for Texas taxpayers, with estimates of over $500 million in higher fees as the state is forced to work with smaller, less experienced and less sophisticated banks who prioritize ideology over economics.

Oklahoma

Oklahoma lawmakers are considering a bill that would prohibit government entities from contracting with companies that have restrictive firearms policies. The bill was filed by state Senator Casey Murdock and is similar to a law passed in Texas in 2021, which temporarily stopped some banks from underwriting municipal bond deals in the state.

While eighteen states have either proposed or passed legislation restricting the state from doing business with investors that practice ESG investing, the reality is that roughly 20 of the 35 anti-ESG-related bills introduced during the past two years failed to become law. In addition to having a very low success rate, these state-level efforts could cost taxpayers over $708 million, according to a study published by the nonprofit Sunrise Project.

Anti-ESG in the Capital markets

Anti-ESG Funds

Recently, two investment vehicles have been launched that aim to provide private investors with an alternative way of investing by offering a portfolio of companies that either don't consider Environmental, Social and Governance (ESG) factors or overweight poorly performing companies on ESG factors. One such fund, advertising itself as a “post-ESG” investor, is backed by prominent investors such as Peter Thiel and Bill Ackman, who believe that traditional ESG investing may limit the potential return on investments. These investment vehicles have been successful in attracting several hundred million dollars from investors who are looking to ignore ESG factors and prefer to focus on traditional financial metrics. However, it's worth noting that ESG investing has gained significant momentum in recent years, with over $35 trillion dollars of assets under management currently taking ESG factors into account.

This shift in investment approach has been driven by the growing awareness of the materiality of ESG factors on long-term financial performance, and the increasing pressure from regulators, investors and other stakeholders to integrate these factors into investment decisions. Among the majority, there is a consensus that climate risk is investment risk.

Conservatism at Annual General Meetings

During last year's annual general meetings (AGMs) of shareholders, a record number of conservative shareholder resolutions were filed. These resolutions were primarily focused on asking companies like ExxonMobil to ignore all other resolutions and JP Morgan to transform itself into a public benefit corporation. These resolutions were intended to push these companies to live up to their stakeholder commitments and formally abandon shareholder interests. Additionally, many other conservative shareholder resolutions asked companies to explore the impact of diversity, equity, and inclusion practices on their white (male) employees.

These conservative shareholder resolutions were not designed to shape corporate policy or to win, but rather to generate news and create the appearance of a debate. However, when looking at the actual votes, the average level of support received was 7%. Excluding these 43 proposals, the average success rate was 30%.

This data indicates that shareholders have looked at these proposals and concluded that anti-ESG proposals are far less material than ESG proposals. A recent Morningstar analysis concurs with this conclusion and suggests that "the reality is that most of these proposals did not garner much support. However, these proposals did receive a lot of attention, and perhaps that was the point".

What are the Arguments Against ESG?

Third-Party Ratings

While much progress has been made in ESG ratings and standards setting, the industry still lacks a globally recognized set of reporting frameworks and benchmarks to clearly define what qualifies as ESG. Many financial organizations provide detailed assessments and ESG ratings of individual companies, but these systems are not without their flaws. They can introduce biases and may be based on questionable or inconsistent data. Despite the progress made in developing comprehensive standards, the consistency and reliability of rating systems remain a work in progress.

For example, companies like Tesla may seem to be an ESG company based on their "E" scores, which measure environmental performance. However, the company may rank poorly in the "S" (social) and "G" (governance) categories. This is demonstrated by the fact that Tesla was removed from the S&P 500 ESG Index due to its lack of a low-carbon strategy as well as social and governance issues. This highlights the fact that achieving one component of ESG, no matter how compelling, does not necessarily equate to a strong case for investment.

It is important to note that we do not recommend investing in products based solely on a rating system. In developing a case for ESG investments, we believe scoring systems should be used in conjunction with fundamental research and the ongoing analysis of ESG policies and practices. This will provide a more comprehensive and accurate understanding of a company's ESG performance, rather than relying solely on a rating or score.

Furthermore, investors should be mindful that ESG ratings can be influenced by the company's self-reported data, which may not always be accurate or complete.

ESG Fund Underperformance

In 2022, the approach of funds linked to environmental, social and governance principles to minimize risks tied to those three factors did not help protect investors from the financial market decline. The 10 largest ESG funds by assets all posted double-digit losses, with many falling more than the S&P 500’s 14.8% decline, including BlackRock and Vanguard's funds. The worst performer was the $6 billion Brown Advisory Sustainable Growth Fund, which slumped 28.1% due in part to its heavy investments in the technology sector, which has been hard hit this year.

Proponents of the anti-ESG movement have been quick to point to this trend as a sign that ESG investing doesn’t work. However, it is perhaps more accurate to say that not all ESG funds are made equal. In fact, many have come under scrutiny because of greenwashing – the misrepresentation of a product, service or investment by making it appear to be more sustainable than it actually is.

This is not always intentional, however. Because larger companies have more resources to dedicate to ESG reporting, they tend to command higher ESG scores. Additionally, less capital-intensive industries such as technology tend to have lower operational (and therefore lower carbon) footprints, which also results in more favorable ESG evaluations. Combining these two factors, it’s easy to see how an ESG fund or ETF that relies heavily on ESG scores might be overweight large-cap technology. As we’ve discussed in earlier installations of The Green Tea (How to Invest Through Economic Cycles), tech companies tend to fare poorly in economic contractions. With this in mind, it is intuitive that ESG funds and ETFs that are heavily weighted towards the technology sector would be underperforming given the current economic macro.

Shifting Dynamic – In a Recession, Investors Care for Income

During a recession, investors will need to be more selective when it comes to their ESG investments. Having a responsible investing policy and a plan for implementing it, supported by data, will be crucial for attracting capital. In the past, screening out companies in capital-intensive industries based on their perceived carbon footprint was enough, but this approach is likely to result in underperformance. Industries that have faced the most ESG scrutiny, such as energy and industrials, are those that are best equipped to weather an economic downturn.

Energy stocks, which have already seen significant gains in the past two years, may continue to outperform the market in 2023, driven by higher dividends rather than oil prices. Energy companies have been increasing their dividends to attract income investors. For example, Diamondback Energy Inc. has increased its payout by 412%, and five of the S&P 500's 10 biggest dividend boosts have come from the energy sector. These higher dividends will be even more attractive if the US economy enters a recession, which would increase the demand for cash.

To capitalize on the potential outperformance of these industries, ESG investors will need to thoroughly research companies and compare their performance to industry peers. This will involve analyzing the company's policies and practices, as well as its performance on environmental, social, and governance factors. Investors should also consider the long-term potential of the company and its industry, as well as the company's financial strength and stability. This level of diligence serves only to bolster asset managers’ investment policies and performance.

By causing investors, regulators, and consumers alike to think more critically about ESG investing, the Anti-ESG movement has the potential to make the ESG movement even stronger.

Sources

Energy Will Be Hot Again in 2023. But Now It’s About Dividends

Republicans Prepare to Ramp Up Their Anti-ESG Campaign in 2023

Big ESG Funds Are Doing Worse Than the S&P 500

How to Confront the Anti-ESG Campaign

Examining the Anti-ESG Movement

How climate denial became the anti-ESG movement

The curious origins of the anti-ESG movement

Governor Ron DeSantis Further Prohibits Woke ESG Considerations from State Investments

ANTI-BOYCOTT LEGISLATION AND TEXAS’ ESG BLACKLIST

Analysis: State anti-ESG laws could cost taxpayers hundreds of millions